Track changes to Xero's lock dates and combine with account filing information from Companies House (where available) to help you keep Xero data stable

Review all draft assets to check none need to be published to balance the registerĭetects changes in a defined period of historical data, since a defined date (such as a filing date).įiling and Payment amounts and dates, direct from HMRC Shows you the last time depreciation was run. We will take your fixed asset depreciation account and compare it to your balance sheet depreciation account, highlight imbalances and then tell you the date that the imbalance started. We will take your fixed asset balance compare it to your balance sheet balance, highlight imbalances and then tell you the date that the imbalance started.Ĭhecks that Fixed Asset Account Types match up to a corresponding General Ledger Account Highlights any draft bills or sales invoices in Xeroĭuplicate contacts go through all your Xero contacts and matches contacts that we think are the same supplier or customer.ĭext Precision looks across invoices and bank transactions and highlights records that it thinks could be unwanted duplicates.Ī useful tool that tracks your spend on client and staff entertainment and will let you know if you have breached any thresholdsĪ simple Corporation Tax estimate to keep track of how much tax your client needs to pay.Īn estimation of VAT liability for the period

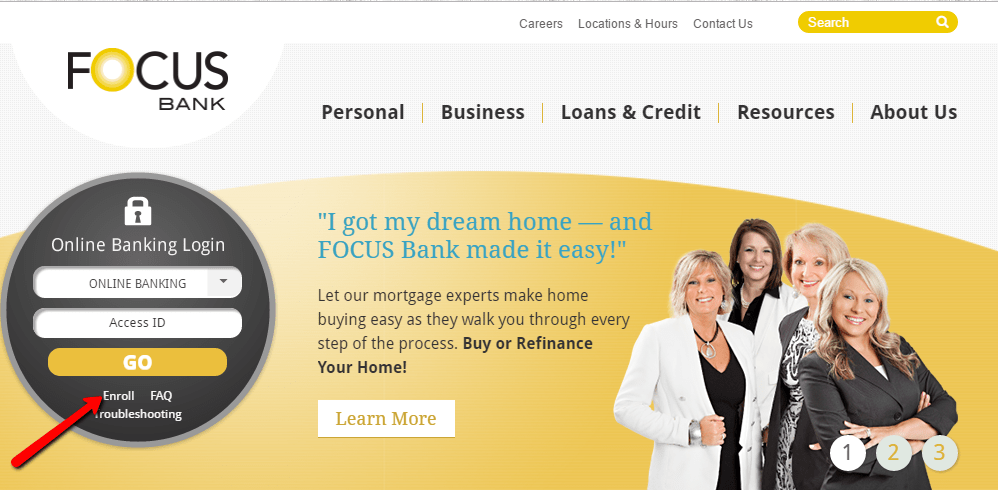

#Focus bank archive

Give your chart of accounts a spring clean - review all of the account codes which have not had activity in a while and archive them. Keep track of who has declared dividends, how much they have declared and when they declared them. Monitor business reliance on key customers and assess associated risk. Search each Contact's transaction history to suggest default reporting codes or VAT Rates which are then pushed back into Xero.ĭesigned to analyse the activity in the General Ledger over time and automatically detect issues. Ideally, all transactions should be reconciled as quickly as possible.Ī review of your aged payables balance - the invoices you have not paid yet.Ĭonfirm with the client that they have paid PAYE as per HMRC This shows the total of unreconciled transactions across all bank accounts in Xero, as well as the oldest item. The Debtor Days ratio shows the average number of days your customers are taking to pay you. # Check Master ListĪ list of all checks available in Dext Precision: Check NameĪ review of your aged receivables balance, find out who is late in paying you! Focus provides a library of these Checks that can be combined together into Flow Templates. Sometimes if a Check raises an alert then you are prompted to take action and fix whatever Dext Precision has found to be the issue. Clicking on the cog will bring up the options that can be adjusted: These Checks have cog icons beside their title.

Some Checks have additional configuration options that can be adjusted while you are in Flow Mode. If the Check has a down-arrow on the right-hand-side, then it can be expanded to show more detailed information by clicking on the card: These are organised into Checks, which you can think of as individual tools or tasks that require review by someone. Focus Daily Digest: An email summarising any Flows that require action for the day.ĭext Precision tackles all sorts of accounting insights, and spots many kinds of errors.Draft Flow: A Flow that has not yet been completed or published.Repeating Flow: A Flow that is set to repeat on a regular basis, which is linked to a Flow Template, Client(s), User(s) and a reporting time period, with a scheduled date and a time span for completion.Flow History: an audit trail of progress on a Flow.Flow: a Flow Template linked to a Client, User and Reporting Period, with a Due Date.Flow Template: a selection of Checks in a specific order, that can be assigned to a Flow.Custom Check: A user-defined Check for directing to non-Dext Precision tasks.Check: A tool or task in Dext Precision, typically with a set of calculated results.Dext Precision Focus allows you to select from a library of tools and build a workflow that suits the business processes you have developed around specific accounting jobs such as Tax Returns, Monthly Bookkeeping or Year End.įor a guide to our latest Focus Update, introducing Repeating Flows, you can watch a quick video guide here: LINK # Focus Glossary

0 kommentar(er)

0 kommentar(er)